403b withdrawal calculator

If you are under 59 12 you may also be. 403 b plans are only available for employees of certain non-profit tax-exempt organizations.

401 K Vs 403 B Vs 457 Plans Compare Employer Sponsored Retirement Plans Mybanktracker

This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing retirement and want help.

. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. Standard Withdrawals Early Withdrawals RMDs and Loans. Brandon Renfro PhD CFP.

You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. If you are under 59 12 you may also. A 403 b plan also commonly referred to as a tax-sheltered annuity is a retirement plan available for.

403 b Withdrawal Rules. While the amount you can contribute will vary on your circumstances in 2018 workers are able to add up to 55000 annually to their 403 b. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement.

Amount You Expected to Withdraw This is the budgeted. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Expected Retirement Age This is the age at which you plan to retire.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. You will need to keep your money in your account until you are 505 years or incur an early withdrawal penalty of 10 of the amount in the 403b account some exceptions. If you are under 59 12 you may also.

The annual rate of return for your 403 b account. And from then on. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

IRA401 k403 b Retirement Calculation. 501c 3 Corps including colleges universities schools. Calculate your earnings and more.

Required Minimum Distribution Calculator. But your earnings and eventual. Retirement Withdrawal Calculator Terms and Definitions.

The actual rate of return is largely. The purpose of the 403b Savings Calculator is to illustrate how making contributions to this retirement account can help you to save for your retirement. Current savings balance Proposed monthly.

Use this calculator to determine how long those funds will last given regular withdrawals. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. 403 b plans are only available for employees of certain non-profit tax-exempt organizations.

You have worked hard to accumulate your savings. Find out how much to put away tax deferred to get a certain amount of money in the future and how much you could expect to draw out of that. 403 b Savings Calculator.

501c 3 Corps including colleges universities schools. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Limits for contributions are quite high.

Use this calculator to estimate how much in taxes you could owe if. 25Years until you retire age 40 to age 65. This calculator assumes that your return is compounded annually and your deposits are made monthly.

403 B Retirement Plan Questions And Answers About 403 B S

Retirement Withdrawal Calculator

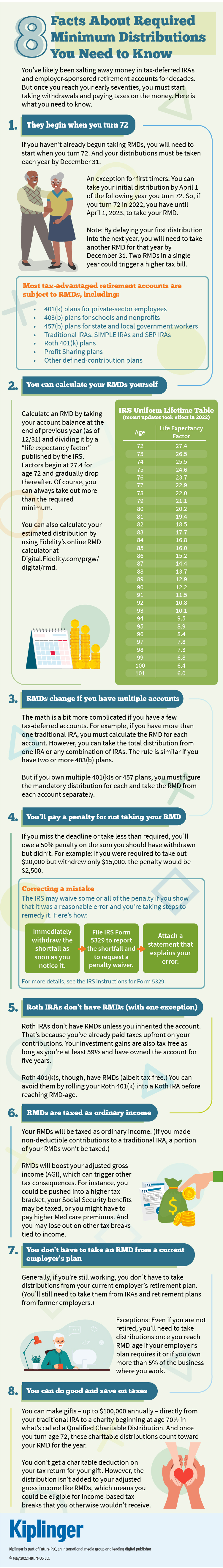

8 Facts About Required Minimum Distributions You Need To Know

Financial Calculators

Roth Ira Vs 403b Which Is Better 2022

403 B Vs 457 B What S The Difference Smartasset

/403_b_plans_-5bfc2f6346e0fb00511a625c.jpg)

Can I Have Both A 403 B And A 401 K

The Cost Of Cashing Out Retirement Plans Early Equitable

403 B Vs 457 B What S The Difference Smartasset

Retirement Plan Withdrawal Calculator Financialfrontline Org

403b Withdrawal Rules Pay Tax On Retirement Income

What Is A 403 B Plan Forbes Advisor

Roth 403 B Plans Rules Tax Benefits And More Smartasset

403b Calculator

A Guide To The 403b Retirement Plan Sofi

401 A Vs 403 B What You Need To Know Smartasset

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account